Capital Allowances

Unlock your tax savings with Capital Allowances

What are capital allowances?

In the UK, capital allowances are a type of tax relief that business owners can claim on certain types of qualifying capital expenditure. These qualifying assets include possessions that they acquire for use in their businesses, but also, unbeknown to most owners, embedded fixtures that were already in the building when it was purchased! There are four main types of capital allowances:

By claiming capital allowances, businesses can reduce their overall tax liability, making it a valuable tool for managing cash flow and investments.

Have the best capital allowances professionals on your side

At Eureka Capital allowances, we have decades of experience in capital allowances, and help our clients to unlock thousands of pounds of hidden tax relief in their properties.

Whether you’re investing in new property, upgrading equipment, or managing a complex portfolio of assets, we provide the insights and guidance needed to manage your tax liability more effectively.

Types of qualifying expenditure

Capital allowances are an essential way of reducing your business tax liabilities through investment in various assets. They can be claimed on various types of qualifying expenditure.

Plant and machinery

One of the most common types of qualifying expenditure, plant and machinery assets refer to any physical items that are essential in the operation of a business. Types of plant and machinery assets include office equipment, such as computers and printers; tools and fixtures used for business operations, like ladders and shelving; and industrial machinery and manufacturing equipment.

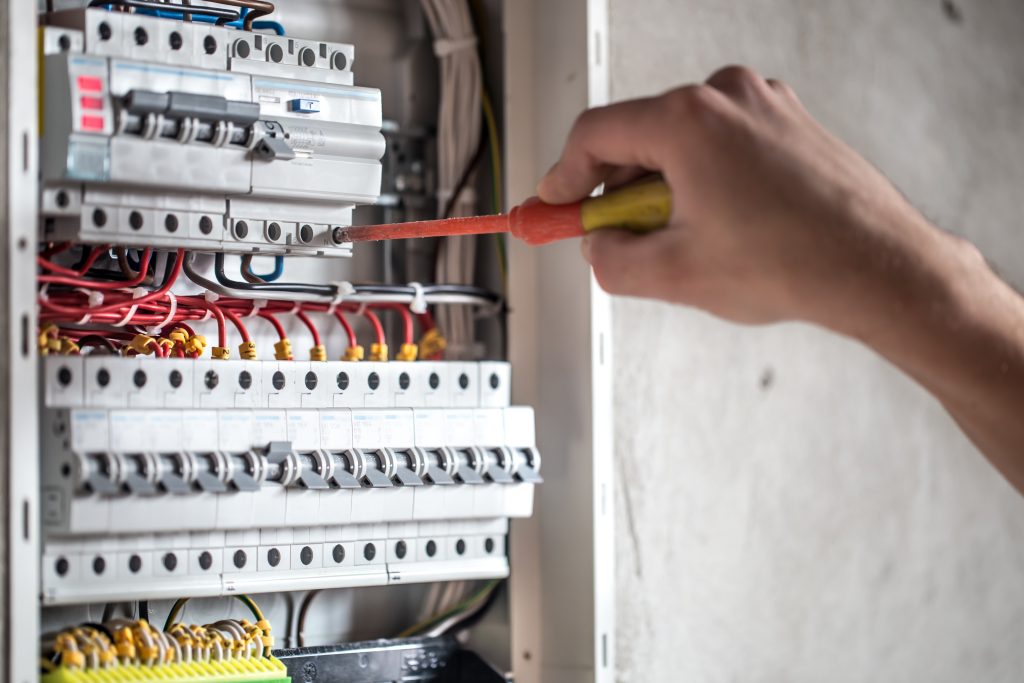

Integral features

Integral features refer to any essential components of a building’s infrastructure that support its operation, including:

- Electrical systems: Wiring, lighting, and power systems.

- Heating and cooling systems: Boilers, radiators, air conditioning, and ventilation.

- Water systems: Plumbing, including hot and cold water systems.

- Lifts, escalators, and moving walkways

These integral features are considered to be qualifying expenditure for capital allowances due to their role in maintaining the building’s operational efficiency.

Equipment used for Research and Development

Equipment used in R&D, such as lab equipment, computers and testing machinery all qualify for capital allowances tax relief. On top of the instruments and equipment used in the research and development process, the cost of building or adapting facilities specifically for R&D purposes also qualifies.

Business vehicles

Commercial vehicles used in a business’s operations, such as vans and lorries, typically qualify for the Annual Investment Allowance, allowing businesses to claim the full cost of these vehicles in the year that they were published. Cars, however, don’t qualify for the AIA and instead can be claimed under the Writing Down Allowance, where different rates apply based on the car’s CO2 emissions.

Buildings and structures

While the cost of purchasing land or buildings don’t qualify for capital allowances, the cost of construction or renovation of offices, factories and warehouses can be claimed under the Structures and Buildings Allowance. Structural improvements, such as adding walls, roofs or extensions to existing commercial buildings also qualify for tax relief.

Why Choose Eureka?

What are capital allowances?

Capital allowances allow businesses to claim tax relief on money spent on assets like equipment, machinery, or vehicles. Instead of deducting the full cost in one go, businesses can spread the deduction over several years, reducing their taxable profits and, in turn, their tax bill. Different types of capital allowances apply to different assets, with varying rates of relief.

What is the difference between the Annual Investment Allowance (AIA) and the Writing Down Allowance (WDA)?

The AIA allows businesses to deduct the full cost of qualifying assets (up to a certain limit) from their taxable profits in the year the asset was purchased. The WDA, on the other hand, allows businesses to spread the cost of an asset over several years, with deductions applied at a set percentage rate each year, typically 6% or 18% depending on the asset type.

Can I claim capital allowances on second-hand assets?

Capital allowances can be claimed on second-hand assets, provided they qualify for the allowance type. For example, most plant and machinery purchases (including second-hand ones) can be claimed under the AIA or WDA, but some specific exclusions, like cars, may have different rules.

What happens if I sell an asset that I've claimed capital allowances on?

If you sell or dispose of an asset that you’ve claimed capital allowances on, you may need to make a balancing charge. This means you might have to pay tax on any proceeds from the sale, as the allowances you’ve claimed reduce the asset’s value for tax purposes. However, if the asset was sold at a loss, you may receive additional relief.

Do buildings qualify for capital allowances?

Buildings themselves don’t qualify for most capital allowances, but you can claim the Structures and Buildings Allowance (SBA) for the construction or renovation of non-residential buildings. Additionally, certain integral features within buildings, like electrical systems or heating, may qualify for WDA at the special rate of 6%.

Questions?

Have any questions that we haven't answered here? Get in touch with us and we will do our best to answer them for you!

Contact us