Capital allowances for holiday and residential parks

Turn your park’s assets into powerful tax savings

Capital allowances on holiday parks

Capital allowances are a form of tax relief that holiday and residential park owners can claim on certain types of capital expenditure, such as assets they use in their business. Unfortunately, capital allowances are widely underclaimed in the holiday and residential park industry! You don’t want to be paying more tax than you have to, so understanding your capital allowances is essential!

For owners of holiday parks, capital allowances provide tax relief on the reduction in value of embedded fixtures that were already on the property when it was purchased, as well as new items, including electrical hook-ups, clubhouses and onsite shops, laundry and shower facilities, swimming pools and infrastructure for static caravans.

Have the best capital allowances consultants on your side

At Eureka Capital allowances, we have over 20 years of experience in capital allowances, and help our clients to unlock thousands of pounds of hidden tax relief in their properties.

We don’t just help holiday and residential park owners, we also provide our knowledge and services to pubs and restaurants, B&Bs, offices, doctors and dentist surgeries and care homes too!

Capital allowances services

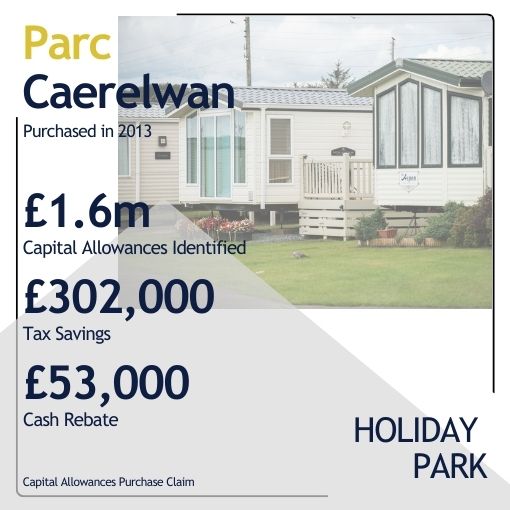

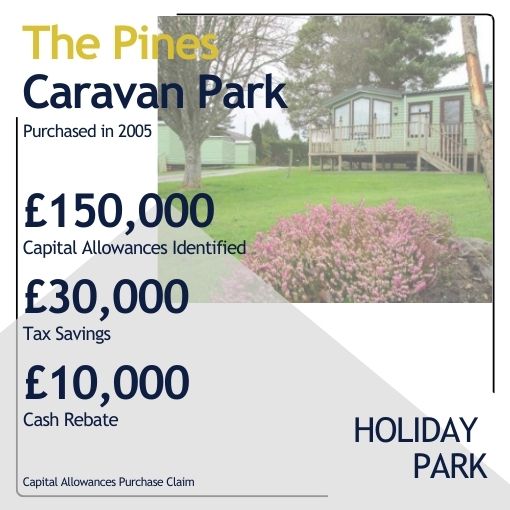

Capital Allowances purchase claims are widely underclaimed in the holiday and residential park industry. At Eureka, our capital allowances services can help to save park owners tens of thousands of pounds by identifying hidden tax relief that they’re unaware of.

Why choose Eureka?

What are capital allowances for holiday parks?

Capital allowances for holiday and residential parks are a form of tax relief that park owners can claim for certain types of capital expenditure, such as the purchase or improvement of caravans, chalets, and site infrastructure (e.g., roads, utilities, and communal facilities). This allows park owners to deduct a portion of the asset’s cost from their taxable profits, reducing their tax liability.

What types of assets in holiday and residential parks qualify for capital allowances?

In holiday and residential parks, capital allowances can be claimed on several types of assets, including:

- Plant and Machinery: Equipment like heating systems, electrical installations, and water treatment facilities.

- Structures and Buildings Allowance (SBA): Costs related to constructing new buildings or improving existing structures.

- Integral Features: Items such as air conditioning systems, lifts, and escalators.

- Fixtures: Items that are attached to the property, such as kitchens and bathrooms in holiday lets.

Can I claim capital allowances on existing assets when I purchase a holiday or residential park?

Yes, you can claim capital allowances on qualifying assets that are included in the purchase of a holiday or residential park. This process typically involves a review of the sale agreement to identify and value the qualifying assets.

A capital allowances survey might be necessary to assess the value of assets such as plant and machinery, fixtures, and integral features. The allowances are then claimed over time as per the tax rules. It’s crucial to ensure that the seller has not already claimed allowances on these assets, as this could affect your eligibility.

Questions?

Have any questions that we haven't answered here? Get in touch with us and we will do our best to answer them for you!

Contact usAbout us

We are team of Capital Allowances Consultants with over 20 years experience, helping commercial property owners unlock hidden tax relief in their property.

Learn more